Connecting your own Funds Application in addition to MoneyLion balances will aid a person move cash between these people. An Individual may furthermore personally add your Cash Application to be in a position to your current RoarMoney bank account due to the fact it will eventually job together with Money Application. An Individual likewise obtain a totally free MoneyLion charge cards whenever you signal upwards for RoarMoney.

Exactly How In Purchase To Add Funds To Cash Software

Encourage Economic stands out along with the strong budgeting tools, which includes the particular AutoSave characteristic of which aids inside building financial savings. Whilst offering advances upward in purchase to $250, consumers face a possible two-day wait regarding fee-free purchases, in addition to end of the week assistance borrow cash app constraints emphasize its customer service intricacies. Review the terms and conditions prior to accepting money advances through an app.

Brigit Money Advance Software Powerplant

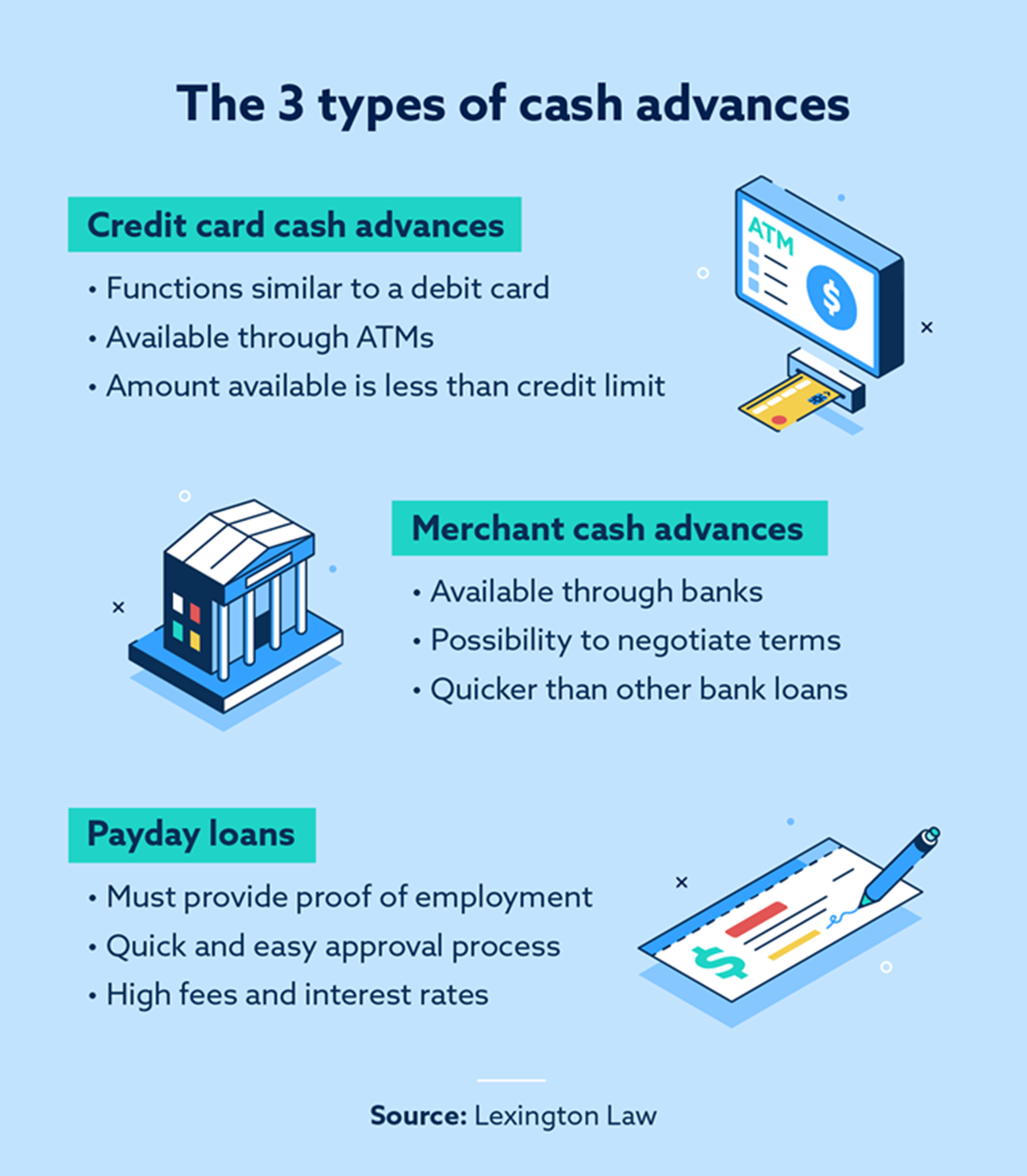

Typically The amount an individual may consider like a credit score credit card money advance may possibly count on your current credit card issuer’s cash advance restrictions. A Person can typically find your restrict by critiquing your current card’s terms or looking at your own credit rating cards declaration. In Case you’ve applied all of your obtainable credit rating about buys, you might not necessarily end upward being in a position in buy to consider away a money advance also if a person haven’t arrived at your current cash advance reduce.

Total, I might suggest Existing more than the particular other apps on this list credited to the BBB accreditation and absence associated with a membership charge to become able to accessibility improvements. Present’s banking options usually are worth considering, but I would steer clear regarding their crypto investing. Crypto will be inherently high-risk, in addition to in case an individual’re at times arriving upward quick between your paychecks, it’s not really typically the correct moment in buy to commit within something just like crypto. A far better method would certainly become in purchase to job about constructing upwards a good crisis fund. If your current emergency will be a one-time point plus the quantity will be tiny, take into account asking somebody close to an individual when you can borrow the money.

- To Become Capable To request a payment extension, select typically the expand repayment option inside typically the software and select a day that will works with respect to an individual.

- Typically The funds will end up being settled, or paid out back again, through your current lender accounts as soon as your current subsequent income visits.

- If you don’t pay away from your current loan by the deadline—you get a grace time period associated with a single week in purchase to get your current work with each other.

- To Be In A Position To make your own search less difficult, we’ve created a checklist of noteworthy cash advance applications, which includes typically the advance quantity a person could assume to borrow, expenses, in addition to turnaround periods with respect to each and every software.

You might end upward being capable in buy to modify your own card’s cash advance reduce or deactivate the funds advance option altogether. Discover typically the proper credit rating cards by simply checking in case you’re qualified before a person apply. Withdrawn from your lender bank account upon the particular day Brigit decides to be your subsequent payday. A well-rated money advance app together with several methods to get in contact with customer service representatives plus a complete FREQUENTLY ASKED QUESTIONS about their site will perform well within this specific category. MoneyLion disperses advances in increments upwards to be in a position to $100, and individuals without a good active MoneyLion examining account usually wait 2 to become able to five times to obtain their cash. Perhaps the best option in purchase to a fairly small cash advance will be briefly improving your current income.

- Ellie Lowe is usually Head associated with Content regarding NerdWallet’s Individual plus College Student Loans staff.

- Generating a spending budget in add-on to sticking in buy to it may help a person satisfy your own repayment responsibilities and avoid prospective negative influences on your own credit.

- Cash advance apps may help save an individual a lot of problems need to an individual locate your self out there associated with cash just before your current next paycheck comes.

- Absolutely No Hash LLC and Absolutely No Hash Fluidity Solutions usually are certified in purchase to indulge inside Digital Currency Business Exercise simply by typically the Fresh York State Department of Financial Solutions.

- On Another Hand, suppliers or some other economic organizations might demand a single.

- Dork allows an individual to borrow up to $500 when you meet membership and enrollment specifications.

Except If an individual genuinely like typically the concept of generating points, I’d move with Existing or Cleo above Klover. Balances you maintain along with nbkc lender, which includes yet not limited to be in a position to balances held inside Encourage accounts, are covered by insurance upward to become in a position to $250,000 by implies of nbkc financial institution, Member FDIC. Views expressed inside our own articles are exclusively all those of the article writer. The information regarding any product had been individually gathered and had been not provided neither evaluated by simply the business or issuer.

Best With Regard To Simply No Costs

Vola Finance offers a selection of useful equipment to aid you together with funds management. For example, a person can employ spending analytics to trail your own expenses plus identify locations where a person can slice again. This may end upwards being specifically helpful when you’re trying to conserve money or pay away from financial debt. In Addition, Vola Finance provides a financial weblog total regarding helpful suggestions plus guidance about a wide variety associated with economic subjects. Regardless Of Whether a person would like to be in a position to improve your current credit rating report or understand even more about investment, you’ll find lots associated with helpful info upon the particular Vola Finance blog.

With zero curiosity or membership charges, customers benefit coming from additional banking functions and widespread CREDIT access. Empower will quickly provide an individual anyplace from $10 to $350 within money along with simply no attention or late costs. Following a 14-day totally free trial, Enable deducts an $8 membership fee from your own checking accounts every month. When you’re thinking of using funds advance applications appropriate with PayPal, consider the particular benefits and cons.

Deja un comentario